What Every Radford Resident Should Know About Termite Control

01/17/2022

Find out what you need to know about termite control in Radford. ...

READ MORE >

Purchasing a home is perhaps the largest and most important investment Americans make today. It is the American Dream and while there are some who may be fortunate enough to pay cash for their home, more often than not, there is a financial commitment that encompasses as many as 30 years worth of payments. Nevertheless, whether a cash purchase or a financed purchase, protecting that investment with homeowner’s insurance is a must.

While protecting one’s home with homeowner’s insurance is the most important thing one can do, the second most important thing is to understand what the insurance policy may or may not cover. According to Fox Business, there are a few things that homeowner’s insurance almost never covers. "Many people don't take the time to understand what is and isn't covered and mistakenly assume insurance will pay for any type of damage," says Carole Walker. Walker went on to say that many policyholders learn about the exclusions the hard way.

While the only sure way of knowing what may or may not be covered is to personally talk to your own insurance company, it is worthy of noting that one of the things not normally covered is structural damage from termite infestation.

It is estimated that termites cause billions of dollars in damage each year in the United States. “If these unwanted guests cause wear and tear to your home, do not expect your insurer to bail you out,” says Janet Patrick, a spokeswoman for the Illinois Insurance Association, an industry lobbying organization in Springfield, Ill. The Fox Business article went on to explain that homeowners could avoid structural damage with early intervention.

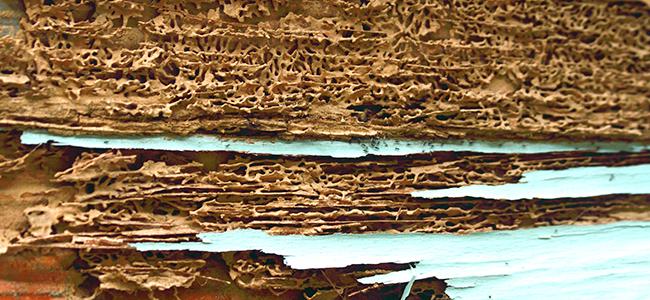

Understanding termite activity helps to understand why most insurance companies omit termite damage from their policies. For example, a termite colony is comprised of a population of destructive insects ranging from a few hundred to hundreds of thousands. These termites work their way inside the wooden structure of the home and, over time, can cause extensive damage requiring costly repairs.

While your homeowner’s insurance may not protect you from termite damage, there are several things that can be done. The initial purchase of a home almost always requires a termite inspection. This gives you peace of mind that your home, at time of purchase, is free of termites. There are also many prevention tips available that, when followed, will drastically reduce the risk of future termite infestations. Additionally, it is highly recommended that you have a professionally trained termite control specialist inspect your home periodically to ensure that it stays termite-free.

01/17/2022

Find out what you need to know about termite control in Radford. ...

READ MORE >

12/17/2021

Termites can cost you thousands of dollars in repairs. Find out what termite damage looks like in Virginia homes, as well as how to avoid it, by re...

READ MORE >

10/20/2021

What's yellow and white and orange all over? None other than these sneaky insects with a penchant for wooden objects! ...

READ MORE >

08/20/2021

What has six legs, two antennae, and insatiable hunger for wooden items in your home? If you said termites, you'd be right!...

READ MORE >

Protect your home and family from nuisance and potentially damaging pests with a Preferred Care home pest control plan. Starting at $49/month

Don't let the bed bugs bite a second longer. Contact American Pest for the most comprehensive bed bug control in the industry. Learn More

Our certified rodent control pros will put an end to your frustration by getting rid of rats and mice inside your home. Learn More

Say goodbye to wood-destroying termites in your home when you contact American Pest for expert termite control. Learn More

Trust American Pest to deliver professional backyard tick control services that are guaranteed to get results. Learn More

Don't spend the warm-weather season indoors, find out how American Pest's professional treatments get rid of mosquitoes. Learn More

Fill out the form and recieve feedback in less than 5 minutes. For immediate service please call.